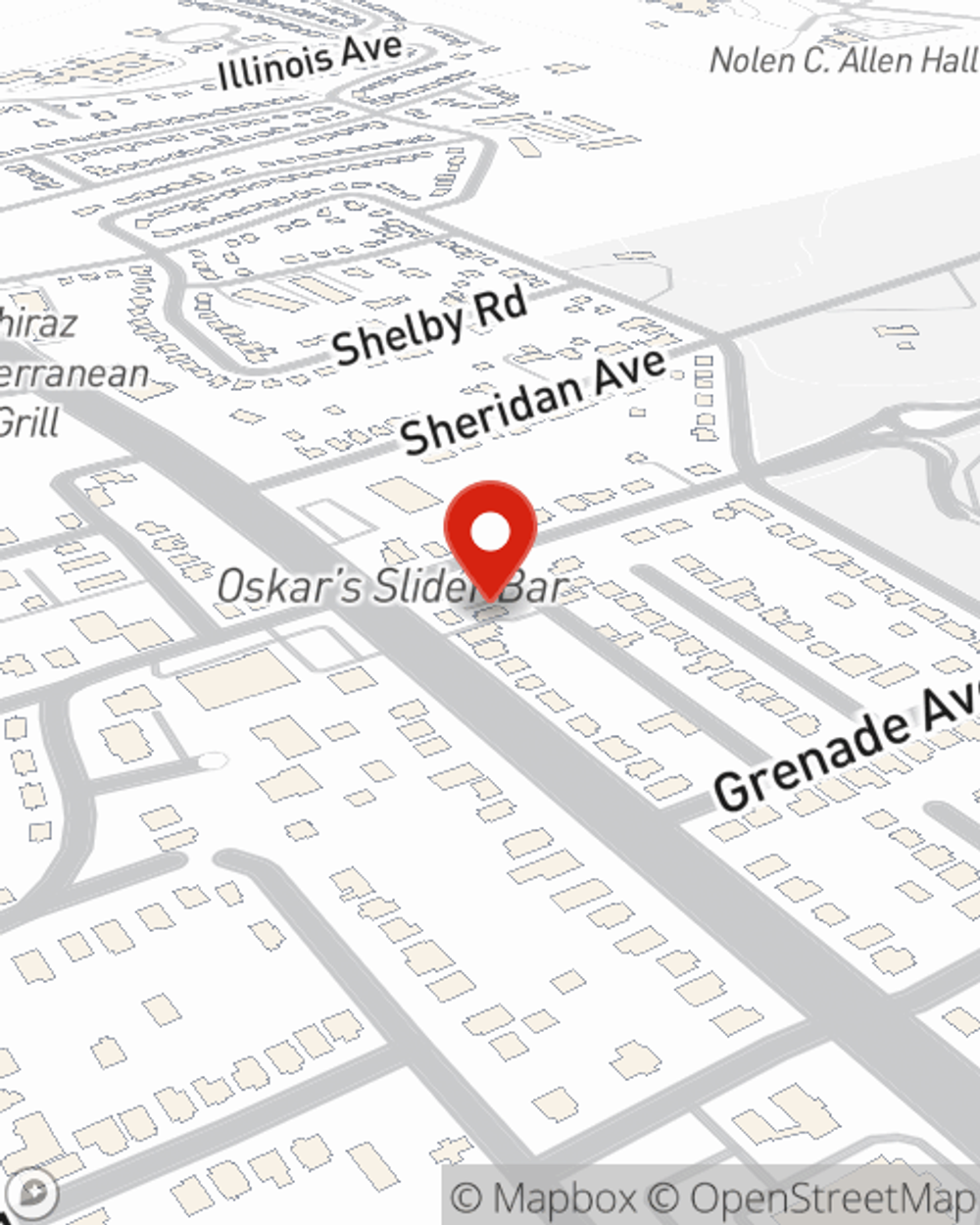

Business Insurance in and around Louisville

Looking for small business insurance coverage?

This small business insurance is not risky

Business Insurance At A Great Value!

Operating your small business takes effort, commitment, and terrific insurance. That's why State Farm offers coverage options like business continuity plans, a surety or fidelity bond, worker's compensation for your employees, and more!

Looking for small business insurance coverage?

This small business insurance is not risky

Keep Your Business Secure

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Kevin Kleier for a policy that protects your business. Your coverage can include everything from errors and omissions liability or business continuity plans to commercial auto insurance or group life insurance if there are 5 or more employees.

Ready to discuss the business insurance options that may be right for you? Contact agent Kevin Kleier's office to get started!

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Kevin Kleier

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.